The Japanese yen is on fire.

That’s the strongest level since October 19, 2014 — right before the Bank of Japan shocked the markets by boosting its quantitative-easing program.

The yen is now up about 10% vs. the dollar in 2016.

Thursday’s surge followed comments from the Bank of Japan’s (BoJ) governor, Haruhiko Kuroda, who suggested that the central bank could ease policy even further if needed.

Generally speaking, a weaker currency helps Japan’s exporters and corporate profits. So, some economists argue that a surging yen is bad for business.

Moreover, Chief Cabinet Secretary Yoshihide Suga said later on Thursday that “We’re watching the foreign exchange market with a sense of tension,” adding that “the government believes excessive and disorderly movements in the exchange rate have a negative effect.”

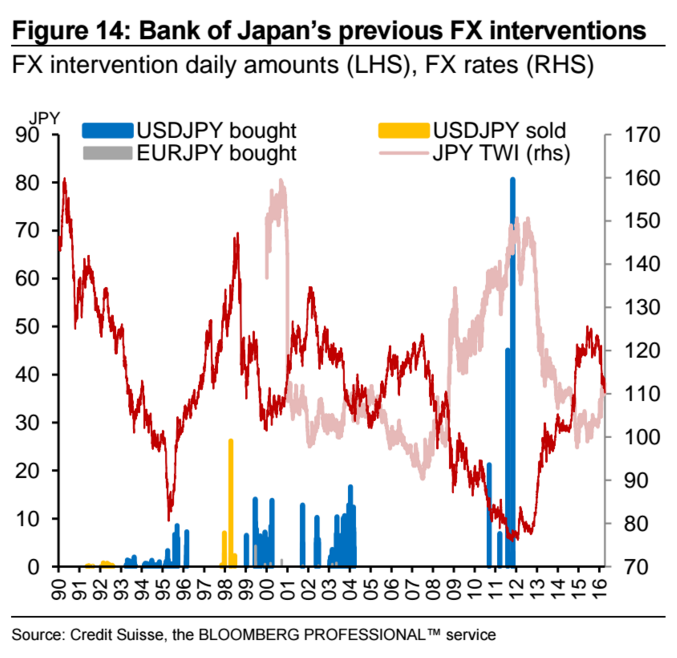

Despite all of that, analysts don’t think the BoJ will intervene this time around given the imminent G7 meeting next month.

“With Japan hosting the next key G7 meeting on 26-27 May, we doubt that politically challenging intervention is likely at this stage, especially if USDJPY’s decline is slow and steady and the Nikkei avoids a disastrous meltdown,” a Credit Suisse research team led byShahab Jalinoos argued in a note on April 6.

“The summit is the focal point of Prime Minister Shinzo Abe’s diplomatic strategy for the year and intervention to weaken the yen would destroy any chance he has of G7 leadership,” explained the Financial Times’ Robin Harding and Claire Jones.

For what it’s worth, Abe told The Wall Street Journal on Tuesday that countries should avoid competitively devaluing their currencies.

As an end note, the Credit Suisse team also cited other tricky political concerns.

“We suspect at a sensitive time ahead of the US presidential election in November, and with the recently agreed Trans Pacific Partnership (TPP) deal still far from being passed by Congress, Japan will not want to risk becoming a candidate for official inclusion in the US Treasury’s FX manipulation report,” they wrote.

“Indeed, aside from brief periods in the post-2008 period, the type of ‘line in the sand’ strategy that was employed in the early 2000s has not been a feature of Japanese currency policy in recent years,” they added.

The yen is stronger by 1.2% at 108.43 against the dollar as of 3:49 p.m. EST.

Japan to start easing entry restrictions for foreign travelers next month, prime mister promises

Japan to start easing entry restrictions for foreign travelers next month, prime mister promises Japan announces plans to take in 300 Syrian refugees over the next five years

Japan announces plans to take in 300 Syrian refugees over the next five years Japan will no longer require pre-departure COVID tests for international travelers

Japan will no longer require pre-departure COVID tests for international travelers Police looking for man who threw paper airplane into Hiroshima atomic bomb monument

Police looking for man who threw paper airplane into Hiroshima atomic bomb monument The Bank of Japan is really jazzed up about the new 10,000 yen bill

The Bank of Japan is really jazzed up about the new 10,000 yen bill McDonald’s new Happy Meals offer up cute and practical Sanrio lifestyle goods

McDonald’s new Happy Meals offer up cute and practical Sanrio lifestyle goods All-you-can-drink Starbucks and amazing views part of Tokyo’s new 170 meter-high sky lounge

All-you-can-drink Starbucks and amazing views part of Tokyo’s new 170 meter-high sky lounge More foreign tourists than ever before in history visited Japan last month

More foreign tourists than ever before in history visited Japan last month Studio Ghibli glasses cases let anime characters keep an eye on your spectacles

Studio Ghibli glasses cases let anime characters keep an eye on your spectacles Beautiful Sailor Moon manhole cover coasters being given out for free by Tokyo tourist center

Beautiful Sailor Moon manhole cover coasters being given out for free by Tokyo tourist center We try out “Chan Ramen”, an underground type of ramen popular in the ramen community

We try out “Chan Ramen”, an underground type of ramen popular in the ramen community Starbucks reopens at Shibuya Scramble Crossing with new look and design concept

Starbucks reopens at Shibuya Scramble Crossing with new look and design concept Mister Donut ready to make hojicha dreams come true in latest collab with Kyoto tea merchant

Mister Donut ready to make hojicha dreams come true in latest collab with Kyoto tea merchant Japanese customer finds run-in with “Indian” convenience store clerk a refreshing experience

Japanese customer finds run-in with “Indian” convenience store clerk a refreshing experience Why is Japan such an unpopular tourist destination?

Why is Japan such an unpopular tourist destination? Disney princesses get official manga makeovers for Manga Princess Cafe opening in Tokyo

Disney princesses get official manga makeovers for Manga Princess Cafe opening in Tokyo Beautiful new Final Fantasy T-shirt collection on the way from Uniqlo【Photos】

Beautiful new Final Fantasy T-shirt collection on the way from Uniqlo【Photos】 Is the new Shinkansen Train Desk ticket worth it?

Is the new Shinkansen Train Desk ticket worth it? Foreign English teachers in Japan pick their favorite Japanese-language phrases【Survey】

Foreign English teachers in Japan pick their favorite Japanese-language phrases【Survey】 Japanese convenience store packs a whole bento into an onigiri rice ball

Japanese convenience store packs a whole bento into an onigiri rice ball Studio Ghibli releases Kiki’s Delivery Service chocolate cake pouches in Japan

Studio Ghibli releases Kiki’s Delivery Service chocolate cake pouches in Japan Japan’s bone-breaking and record-breaking roller coaster is permanently shutting down

Japan’s bone-breaking and record-breaking roller coaster is permanently shutting down New definition of “Japanese whiskey” goes into effect to prevent fakes from fooling overseas buyers

New definition of “Japanese whiskey” goes into effect to prevent fakes from fooling overseas buyers Our Japanese reporter visits Costco in the U.S., finds super American and very Japanese things

Our Japanese reporter visits Costco in the U.S., finds super American and very Japanese things Studio Ghibli unveils Mother’s Day gift set that captures the love in My Neighbour Totoro

Studio Ghibli unveils Mother’s Day gift set that captures the love in My Neighbour Totoro Foreign passenger shoves conductor on one of the last full runs for Japan’s Thunderbird train

Foreign passenger shoves conductor on one of the last full runs for Japan’s Thunderbird train Domino’s Japan now sells…pizza ears?

Domino’s Japan now sells…pizza ears? New Japanese KitKat flavour stars Sanrio characters, including Hello Kitty

New Japanese KitKat flavour stars Sanrio characters, including Hello Kitty Kyoto creates new for-tourist buses to address overtourism with higher prices, faster rides

Kyoto creates new for-tourist buses to address overtourism with higher prices, faster rides Sales of Japan’s most convenient train ticket/shopping payment cards suspended indefinitely

Sales of Japan’s most convenient train ticket/shopping payment cards suspended indefinitely Sold-out Studio Ghibli desktop humidifiers are back so Totoro can help you through the dry season

Sold-out Studio Ghibli desktop humidifiers are back so Totoro can help you through the dry season Japanese government to make first change to romanization spelling rules since the 1950s

Japanese government to make first change to romanization spelling rules since the 1950s Ghibli founders Toshio Suzuki and Hayao Miyazaki contribute to Japanese whisky Totoro label design

Ghibli founders Toshio Suzuki and Hayao Miyazaki contribute to Japanese whisky Totoro label design Doraemon found buried at sea as scene from 1993 anime becomes real life【Photos】

Doraemon found buried at sea as scene from 1993 anime becomes real life【Photos】 Tokyo’s most famous Starbucks is closed

Tokyo’s most famous Starbucks is closed One Piece characters’ nationalities revealed, but fans have mixed opinions

One Piece characters’ nationalities revealed, but fans have mixed opinions We asked a Uniqlo employee what four things we should buy and their suggestions didn’t disappoint

We asked a Uniqlo employee what four things we should buy and their suggestions didn’t disappoint Princesses, fruits, and blacksmiths: Study reveals the 30 most unusual family names in Japan

Princesses, fruits, and blacksmiths: Study reveals the 30 most unusual family names in Japan Weak yen should have Japan fast-tracking reopening to foreign tourists, prominent politician says

Weak yen should have Japan fast-tracking reopening to foreign tourists, prominent politician says Foreign press greeted by unusually conspicuous ninjas at G7 summit

Foreign press greeted by unusually conspicuous ninjas at G7 summit Why is Japan such an unpopular tourist destination?

Why is Japan such an unpopular tourist destination? Our reporter’s in relationship trouble after fake girlfriend loses $10,000 on a World Cup bet

Our reporter’s in relationship trouble after fake girlfriend loses $10,000 on a World Cup bet 7 things that surprise a visitor to Laos 【Photos】

7 things that surprise a visitor to Laos 【Photos】 In Luffy we trust – Man arrested for selling dollar bills with unlicensed One Piece stickers

In Luffy we trust – Man arrested for selling dollar bills with unlicensed One Piece stickers Japan considering doubling entry cap for overseas travelers, waiving on-arrival PCR tests soon

Japan considering doubling entry cap for overseas travelers, waiving on-arrival PCR tests soon Why was the 2,000-yen bill left out of Japan’s yen redesign, and how does it feel about the snub?

Why was the 2,000-yen bill left out of Japan’s yen redesign, and how does it feel about the snub? Japan to begin accepting tourists from the U.S., three other countries this month

Japan to begin accepting tourists from the U.S., three other countries this month App that buys your receipts crashes within hours of release due to too many users

App that buys your receipts crashes within hours of release due to too many users Bandai to launch online capsule machines controlled by smartphone

Bandai to launch online capsule machines controlled by smartphone Former idol singer arrested on fraud charges, police say she found victims through dating apps

Former idol singer arrested on fraud charges, police say she found victims through dating apps Tokyo goes dark as Governor asks for lights out in the city to help fight pandemic 【Pics, Videos】

Tokyo goes dark as Governor asks for lights out in the city to help fight pandemic 【Pics, Videos】 Tokyo’s most terrifying advertisement is hiding in plain sight in busiest part of the city【Video】

Tokyo’s most terrifying advertisement is hiding in plain sight in busiest part of the city【Video】 Executives arrested from scam dating sites that had 2.7 million users and only one female member

Executives arrested from scam dating sites that had 2.7 million users and only one female member Japanese politician pushing to double price of cigarettes in Japan by start of 2020 Olympics

Japanese politician pushing to double price of cigarettes in Japan by start of 2020 Olympics Keio Plaza Hotel Hachioji to serve adorably delicious Hello Kitty and Little Twin Stars buffet

Keio Plaza Hotel Hachioji to serve adorably delicious Hello Kitty and Little Twin Stars buffet

Leave a Reply