As more and more parents worry about the effects of bullying, one Tokyo insurance company offers a solution.

A study by Japan’s Ministry of Education, Culture, Sports, Science and Technology found 410,000 cases of reported bullying among elementary, middle, and high school students in 2017, an increase of roughly 90,000 reports compared to the previous year. While it’s not clear if the increase is due to meaner kids or a greater willingness to report incidents, there’s no question that bullying has become an increasingly talked-about subject in Japan, with many parents and educators struggling to find the best way to address a problem that wasn’t so commonly or openly discussed in their youth.

Tokyo-based Yell thinks it may have a solution, or at least a way to improve the situation. However, Yell isn’t an education or psychology institute, but an insurance company.

As of this week, Yell is offering bully insurance, and is thought to be the first company in Japan to provide such coverage. However, Yell isn’t handing out payments whenever someone lobs a schoolyard put-down at their clients’ children. Instead, the service offers financial support in the case of legal or medical fees stemming from bullying.

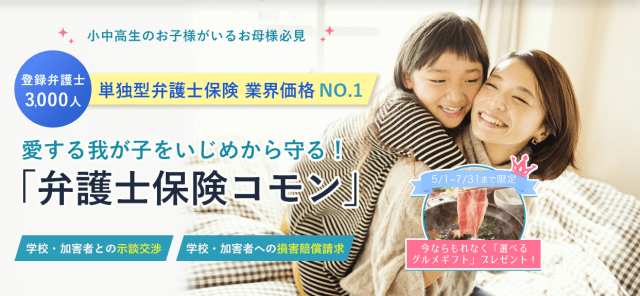

▼ Promotional image for Yell’s bully insurance

For starters, parents who purchase bully insurance can consult with Yell’s partner lawyers, free of charge, if they feel their child is being bullied, and want to explore legal options for rectifying the situation. The lawyers can advise parents on how to go about documenting and compiling evidence that will prove the situation constitutes bullying, as establishing that understanding is the first step in compelling schools or the bullies’ parents to take actions to stop the bullying.

Bully insurance, which costs 2,640 yen (US$24) a month, also provides partial compensation for more involved legal services and representation which require payment of lawyers’ fees. Medical fees are also covered, whether for injuries a client’s child sustained at the hands of bullies, or for injuries the client’s child caused by fighting back, as is compensation for personal property damaged or destroyed as part of bullying-related events.

Some might argue that nothing is going to more quickly make a kid the target of ridicule from his peers than them knowing that he his parents have purchased bully insurance for him, so odds are clients are advised to keep their coverage on the down-low. And while still others may hold that the better way to deal with bullies is a swift fist in the mouth, Japan is general doesn’t go for violent problem-solving, and it’s likely that Yell’s service is going to be an attractive solution to some number of Japanese parents.

Source: Yell, Niconico News via Jin

Top image: Pakutaso

Insert images: Yell

● Want to hear about SoraNews24’s latest articles as soon as they’re published? Follow us on Facebook and Twitter!

“Bully insurance” now on the rise, with many more practical uses than just insuring bullying

“Bully insurance” now on the rise, with many more practical uses than just insuring bullying When bullying happens in Japan, should parents go to the police? We ask an educator

When bullying happens in Japan, should parents go to the police? We ask an educator If you have an apartment in Japan, your “fire disaster insurance” may also be toilet insurance

If you have an apartment in Japan, your “fire disaster insurance” may also be toilet insurance Japanese Twitter user’s sad memory of when school literally refused to look at bullying problem

Japanese Twitter user’s sad memory of when school literally refused to look at bullying problem Japanese company offers insurance plan to protect against false train groping accusations

Japanese company offers insurance plan to protect against false train groping accusations Tokyo Tsukiji fish market site to be redeveloped with 50,000-seat stadium, hotel, shopping center

Tokyo Tsukiji fish market site to be redeveloped with 50,000-seat stadium, hotel, shopping center Red light district sushi restaurant in Tokyo shows us just how wrong we were about it

Red light district sushi restaurant in Tokyo shows us just how wrong we were about it Japanese ramen restaurants under pressure from new yen banknotes

Japanese ramen restaurants under pressure from new yen banknotes Beautiful Red and Blue Star luxury trains set to be Japan’s new Hokkaido travel stars

Beautiful Red and Blue Star luxury trains set to be Japan’s new Hokkaido travel stars McDonald’s new Happy Meals offer up cute and practical Sanrio lifestyle goods

McDonald’s new Happy Meals offer up cute and practical Sanrio lifestyle goods Mt. Koya planning to instate visitor’s tax to cope with huge tourist numbers

Mt. Koya planning to instate visitor’s tax to cope with huge tourist numbers We tried Korea’s way-too-big King Tonkatsu Burger at Lotteria 【Taste Test】

We tried Korea’s way-too-big King Tonkatsu Burger at Lotteria 【Taste Test】 French Fries Bread in Tokyo’s Shibuya becomes a hit on social media

French Fries Bread in Tokyo’s Shibuya becomes a hit on social media Foreign English teachers in Japan pick their favorite Japanese-language phrases【Survey】

Foreign English teachers in Japan pick their favorite Japanese-language phrases【Survey】 Studio Ghibli releases new action figures featuring Nausicaä of the Valley of the Wind characters

Studio Ghibli releases new action figures featuring Nausicaä of the Valley of the Wind characters All-you-can-drink Starbucks and amazing views part of Tokyo’s new 170 meter-high sky lounge

All-you-can-drink Starbucks and amazing views part of Tokyo’s new 170 meter-high sky lounge More foreign tourists than ever before in history visited Japan last month

More foreign tourists than ever before in history visited Japan last month Starbucks reopens at Shibuya Scramble Crossing with new look and design concept

Starbucks reopens at Shibuya Scramble Crossing with new look and design concept Studio Ghibli glasses cases let anime characters keep an eye on your spectacles

Studio Ghibli glasses cases let anime characters keep an eye on your spectacles Is the new Shinkansen Train Desk ticket worth it?

Is the new Shinkansen Train Desk ticket worth it? New private rooms on Tokaido Shinkansen change the way we travel from Tokyo to Kyoto

New private rooms on Tokaido Shinkansen change the way we travel from Tokyo to Kyoto Beautiful Ghibli sealing wax kits let you create accessories and elegant letter decorations【Pics】

Beautiful Ghibli sealing wax kits let you create accessories and elegant letter decorations【Pics】 Studio Ghibli releases Kiki’s Delivery Service chocolate cake pouches in Japan

Studio Ghibli releases Kiki’s Delivery Service chocolate cake pouches in Japan New definition of “Japanese whiskey” goes into effect to prevent fakes from fooling overseas buyers

New definition of “Japanese whiskey” goes into effect to prevent fakes from fooling overseas buyers Our Japanese reporter visits Costco in the U.S., finds super American and very Japanese things

Our Japanese reporter visits Costco in the U.S., finds super American and very Japanese things Studio Ghibli unveils Mother’s Day gift set that captures the love in My Neighbour Totoro

Studio Ghibli unveils Mother’s Day gift set that captures the love in My Neighbour Totoro Domino’s Japan now sells…pizza ears?

Domino’s Japan now sells…pizza ears? New Japanese KitKat flavour stars Sanrio characters, including Hello Kitty

New Japanese KitKat flavour stars Sanrio characters, including Hello Kitty New Pokémon cakes let you eat your way through Pikachu and all the Eevee evolutions

New Pokémon cakes let you eat your way through Pikachu and all the Eevee evolutions Sales of Japan’s most convenient train ticket/shopping payment cards suspended indefinitely

Sales of Japan’s most convenient train ticket/shopping payment cards suspended indefinitely Sold-out Studio Ghibli desktop humidifiers are back so Totoro can help you through the dry season

Sold-out Studio Ghibli desktop humidifiers are back so Totoro can help you through the dry season Japanese government to make first change to romanization spelling rules since the 1950s

Japanese government to make first change to romanization spelling rules since the 1950s Ghibli founders Toshio Suzuki and Hayao Miyazaki contribute to Japanese whisky Totoro label design

Ghibli founders Toshio Suzuki and Hayao Miyazaki contribute to Japanese whisky Totoro label design Doraemon found buried at sea as scene from 1993 anime becomes real life【Photos】

Doraemon found buried at sea as scene from 1993 anime becomes real life【Photos】 Tokyo’s most famous Starbucks is closed

Tokyo’s most famous Starbucks is closed One Piece characters’ nationalities revealed, but fans have mixed opinions

One Piece characters’ nationalities revealed, but fans have mixed opinions We asked a Uniqlo employee what four things we should buy and their suggestions didn’t disappoint

We asked a Uniqlo employee what four things we should buy and their suggestions didn’t disappoint Princesses, fruits, and blacksmiths: Study reveals the 30 most unusual family names in Japan

Princesses, fruits, and blacksmiths: Study reveals the 30 most unusual family names in Japan Japan’s amazing healthcare system summed up in photo of hospital bill for father’s heart surgery

Japan’s amazing healthcare system summed up in photo of hospital bill for father’s heart surgery Harsh retribution for school bullies using Japanese law suggested on Twitter, but it’ll take time

Harsh retribution for school bullies using Japanese law suggested on Twitter, but it’ll take time Tough-as-nails bullied Japanese schoolgirl stays home from school, but not because she was sad

Tough-as-nails bullied Japanese schoolgirl stays home from school, but not because she was sad Court verdict reached on Kyoto schoolgirl who sued bullies for causing her mental illness

Court verdict reached on Kyoto schoolgirl who sued bullies for causing her mental illness Curry restaurants across Japan create social media movement: “Don’t blame the curry!”

Curry restaurants across Japan create social media movement: “Don’t blame the curry!” Japan’s prime minister wants to make it illegal for parents to hit kids when disciplining them

Japan’s prime minister wants to make it illegal for parents to hit kids when disciplining them Japanese government wants to give people an extra 80,000 yen to have babies, but will it work?

Japanese government wants to give people an extra 80,000 yen to have babies, but will it work? Parents of bullied teenage girl who committed suicide commission portrait to “attend” Seijinshiki

Parents of bullied teenage girl who committed suicide commission portrait to “attend” Seijinshiki Ninety-nine problems, but looking like a 5-year-old playa ain’t one of them

Ninety-nine problems, but looking like a 5-year-old playa ain’t one of them How to get free healthcare in Japan without insurance

How to get free healthcare in Japan without insurance Snappy as they look, Japanese school uniforms can be an extremely expensive hassle for parents

Snappy as they look, Japanese school uniforms can be an extremely expensive hassle for parents Sompo Japan offers nation’s first online flaming insurance

Sompo Japan offers nation’s first online flaming insurance Mayor of Osaka wants to legally control when kids can and can’t use smartphones in their own home

Mayor of Osaka wants to legally control when kids can and can’t use smartphones in their own home Yakuza may be blocked from using all expressways in Japan within the decade

Yakuza may be blocked from using all expressways in Japan within the decade 5 powerful reasons to be a woman in Japan 【Women in Japan Series】

5 powerful reasons to be a woman in Japan 【Women in Japan Series】 Tokyo University students rank the top 12 video games for cultivating smart kids

Tokyo University students rank the top 12 video games for cultivating smart kids

Leave a Reply